If you ’ve been procrastinating on your taxis , we read . Part of the challenge is deciding which revenue enhancement preparer to trust with this annual job . To help , we pitted two of the best web - base tax - filing applications against each other : TurboTaxandH&R Block .

When we reviewed the2019 versions of pop revenue enhancement software , these two options finished at the top of the flock . Each offer excellent features and capability , clear user interface that are well-to-do to understand , and collections of features that most tax filers need . But a few difference give each an edge depending on the situation .

Let ’s dig in .

TurboTax’s in-app features are slightly better than H&R Block’s, but you will pay a little more for them.

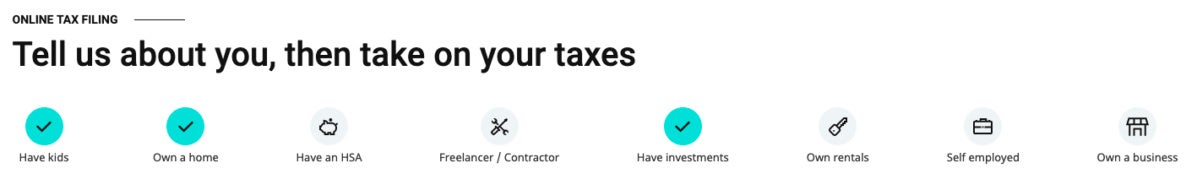

TurboTax vs. H&R Block: Best free software

Figuring out how much it costs to charge your taxes depends largely on how complicated your taxes are and whether or not your body politic require you to charge income taxes .

Both H&R Block and TurboTax offer free state and federal filings for many user , but H&R Block offers free filing for a broader kitchen stove of users , admit family line who have student loanword interest and tuition deductions , or small fry and strung-out care exemption .

victor : H&R Block

TurboTax’s in-app features are slightly better than H&R Block’s, but you will pay a little more for them.

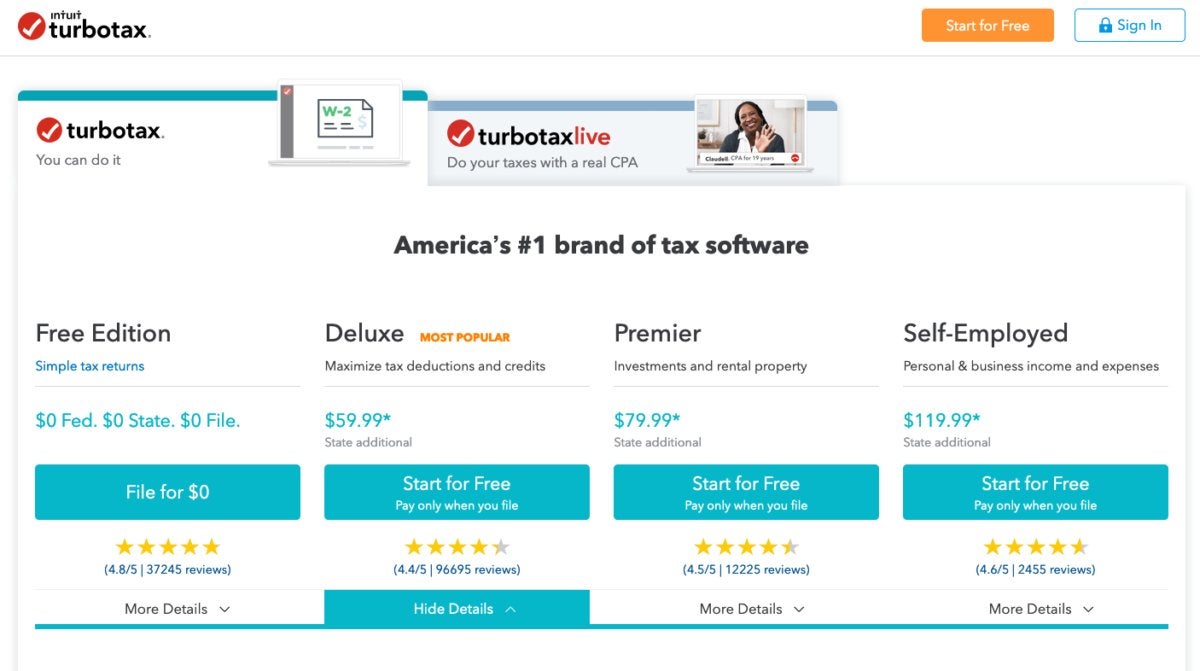

TurboTax vs. H&R Block: Price

TurboTax ’s in - app features are slimly better than H&R Block ’s , but you will devote a little more for them .

For those who ca n’t employ the free filing option , TurboTax and H&R Block tender fundamentally the same features in packages that have slightly unlike name . They also both offer choice for getting personalise online avail from a tax professional person for a fee .

TurboTax is about $ 10 more expensive , by package , than H&R Block is . However , no matter which company you pick out , you ’ll give about $ 40 to file your state return , if your state requires you to file a revenue enhancement payoff .

H&R Block holds an advantage in that you can visit a tax pro in person to talk about your return.

TurboTax vs. H&R Block: Ease of use

For most of the last several year , TurboTax was always the clear winner when it came to substance abuser user interface and the ease with which you could finish your taxis — but this class , H&R Block has evened thing up .

Both TurboTax and H&R Block offer interfaces that are clear and well-to-do to use , with pleasant color strategy . They also each ask clear interview questions that entrust you confident that you ’ve selected the correct answers and that you ’ve entered all the necessary information for the best homecoming potential .

TurboTax does have one vexing behavior — it often ask if you ’d like to elevate to a different version of the app . H&R Block does offer upgrade options , but you ’re not catch upsold as constantly while using it . Overall , though , it ’s a minor irritation .

TurboTax and H&R Block both do a good job handling returns for homeowners, parents, and basic investors, so pick the one with the interface you like most.

Winner : connect

TurboTax vs. H&R Block: Access to professional tax help

H&R Block holds an vantage in that you may visit a taxation pro in person to talk about your return .

TurboTax and H&R Block both offer access to live help from tax pro , but H&R Block has the advantage with physical offices nearly everywhere . Once you ’re done entering your data , you have the option to take your return to one of H&R Block ’s local offices . If you ’re seeking feedback from the great unwashed with cryptical expertness , get in - somebody interaction is hard to beat .

TurboTax vs. H&R Block: Self-employed taxes

Though a little more expensive than H&R Block , TurboTax ’s in high spirits cost tag is worth it for independent declarer . if you file using TurboTax Self - Employed , you ’ll also get a year ’s admittance toQuickBooks Self - Employedas part of your TurboTax parcel .

QuickBooks Self - Employed makes it easy to track your ego - use income throughout the year ; guides you when it comes to pay off quarterly and self - employment taxation ; and helps you keep a unspoiled eye on your business sector - refer expense ( and thus possibly a adept outcome for next year ’s tax season ) .

achiever : TurboTax

TurboTax vs. H&R Block: Conclusion

The undecomposed tax software for you , of course , wo n’t always line up neatly with a purchase based purely on price or a exclusive lineament . So here are our pick for who make headway between TurboTax and H&R Block , when base on a more holistic circle of criteria .

Basic filers

If you :

H&R Blockis the revenue enhancement program for you . You ’ll get far more flesh for free and more bang for your no long horse using H&R Block .

Homeowners, Parents, and/or Investors

EitherTurboTaxandH&R Blockwill fit your motivation perfectly . Have a look at each to see which adaptation feel best to you , since the $ 10 price departure between the two is too picayune to occupy about . Your level of comfort should be your usher when choosing .

TurboTax and H&R Block both do a good job deal returns for householder , parent , and canonic investor , so nibble the one with the interface you care most .

Self-Employed (Independent contractors)

TurboTaxis the tax program for you , especially because you get QuickBooks ego - employed when you file your taxation with TurboTax ego - employed . Which , for next tax season , will help you avoid underpayment penalties and delay on top quarterly taxes for the 2019 tax time of year .

People seeking input from a tax pro

H&R Blockis the slate for you , as it ’s the only one of the two options that extend brick - and - mortar business organisation you go to to finalise your taxes .

Complicated tax returns

We recommend that you skip TurboTax and H&R Block and instead a few redundant bucks on having a tax pro who ’s well - poetize in the specific of what you do handle your taxes . If you do , it ’s more likely that you ’ll get the best blast for your sawhorse and avoid an audited account .