Last week , Apple cover itsfinancial results , and they were the kind that answered the dubiousness , “ Under what lot would fiscal analysts look askance at intimately $ 90 billion in revenue and $ 23 billion in profit ? ” ( resolution : When that company is Apple , and it ’s post blue year - over - year revenue numbers in five of the last six quarters . )

After a couple of years of growth so sudden and massive that cosmologist are analyzing it forclues to the inflationary menstruation during the first few moments of the cosmos , Apple has spent the year - plus … flat . Very immense and profitable 2-dimensional , but flat still . Wall Street , so focused on growth , is a little perplexed .

As is custom , Apple CEO Tim Cook and CFO Luca Maestri hopped on a conference call with financial analysts after the effect . And they let the remainder of us hear in like little sneaky eavesdropper . Here are a few of the things I make from what Apple ’s execs had to say .

A false comparison

There ’s no veridical means to gloss over the fact that Mac sales agreement go down 34 percent versus the yr - agone quarter . And yet , for some cause , Maestri and Cook get out theirTom Sawyer paintbrushesand got to work .

Maestri said the Mac sales drop was “ driven by challenge grocery store condition and compounded by a unmanageable compare in our own business , whereby last year we experienced supply hoo-hah from factory shutdowns in the June fourth part , and were subsequently able to fulfill significant pent - up need during the September quarter . We also had a difference in launching timing , with the MacBook Air establish earlier this year in the June tail compare to the September quarter last twelvemonth . ”

That ’s the “ nut of it , ” as Cook echoed : it ’s not really clean to compare this twelvemonth ’s fourth quarter to last year ’s because during the summertime of 2022 , there was a mill closedown in China , and when it came back online there was pent - up Mac demand . And okay , there ’s Sojourner Truth in there : last year ’s 4th quarter was the individual self-aggrandising Mac quarter ever , and there ’s nowhere to go from there but down .

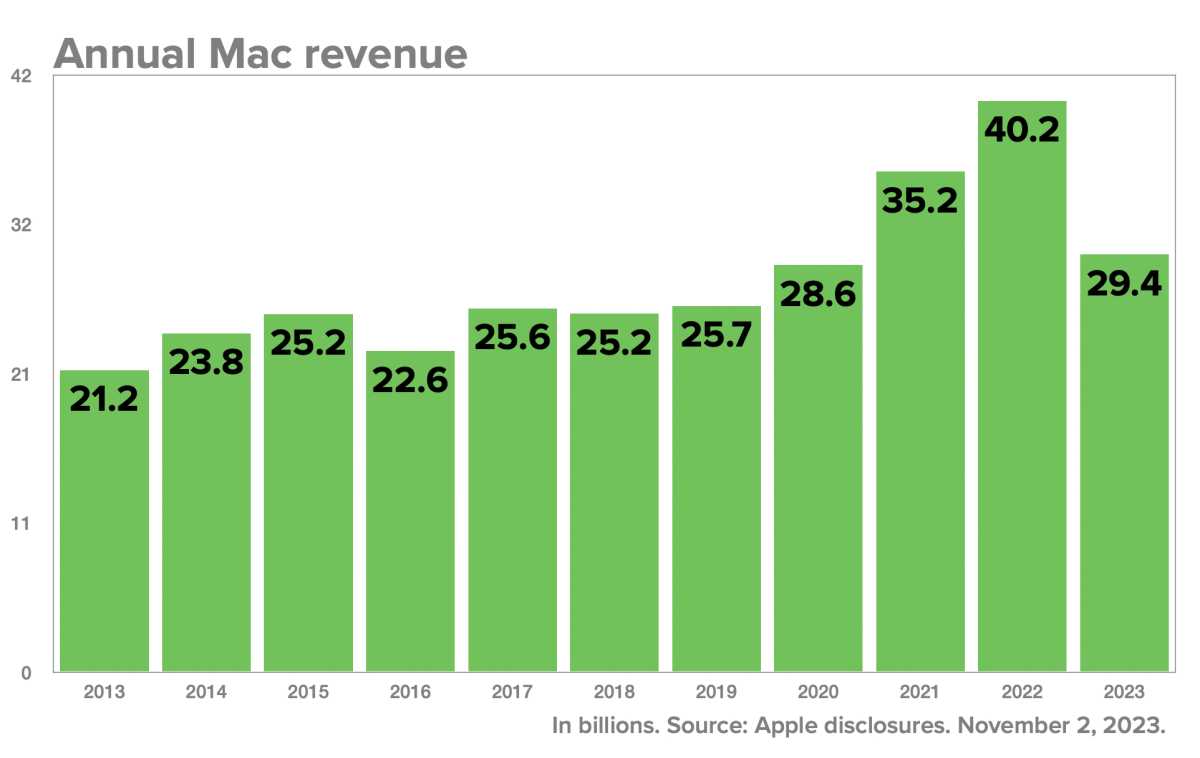

But by using this exculpation , Cook and Maestri are deflecting attention from the literal , incontrovertible numbers : mackintosh gross for financial 2023 was $ 29.4 billion , down 27 percentage from the former year ’s criminal record $ 40.2 billion . That ’s a “ baffling compare ” that includes both the quarter where the Mac was touch on by factory closure and the fourth where Apple sold a whole bunch of Macs in ordering to fulfill requirement . Put them together , and it ’s still a colossal fall in cut-rate sale . This year ’s Mac revenue number was also down 20 percent from financial 2021 when Apple sold $ 35.2 billion in Macs . So it ’s a dramatic drop-off from the last two years of Mac sales , no matter how you slit it .

But here ’s the affair : look back to Mac gross in 2019 and 2020 , before the Mac sales surge driven by the Covid pandemic and the switch to Apple atomic number 14 . In those years , Mac revenue was $ 25.7 billion and $ 28.6 billion , respectively . If you retrieve of the last couple of year as an aberration , the Mac is back where it was – in fact , it ’s up 2.6 pct from fiscal 2020 .

I get that Cook and Maestri are focused on the current result and also probably think of Wall Street as much more focused on the scant - terminus picture than the retentive - terminal figure , but I ca n’t help but feel that their entire approach to the Mac sales shortfall as some sort of impermanent quirk missed a larger point . A impregnable case can be made that Apple had two extraordinary days of Mac sales that added a vast turn of new Mac users and boosted the Mac install base to immortalize heights . And while a plenty of live Mac user bought new Macs in 2021 and 2022 , clearly there ’s still an appetency for the Mac : In 2023 , the numbers returned to the same ballpark they were in pre - pandemic , rather than falling off a cliff .

Maybe Cook and Maestri just want to grit their tooth and await for the moment to pass . After all , the year - agone quarter of Mac sales was the last enormous one . start next sentence , in financial 2024 , they ’ll only have to equate their sale to the relatively lowly numbers of fiscal 2023 . It ’s sure to be a much easier comparison .

What’s in that Services pile?

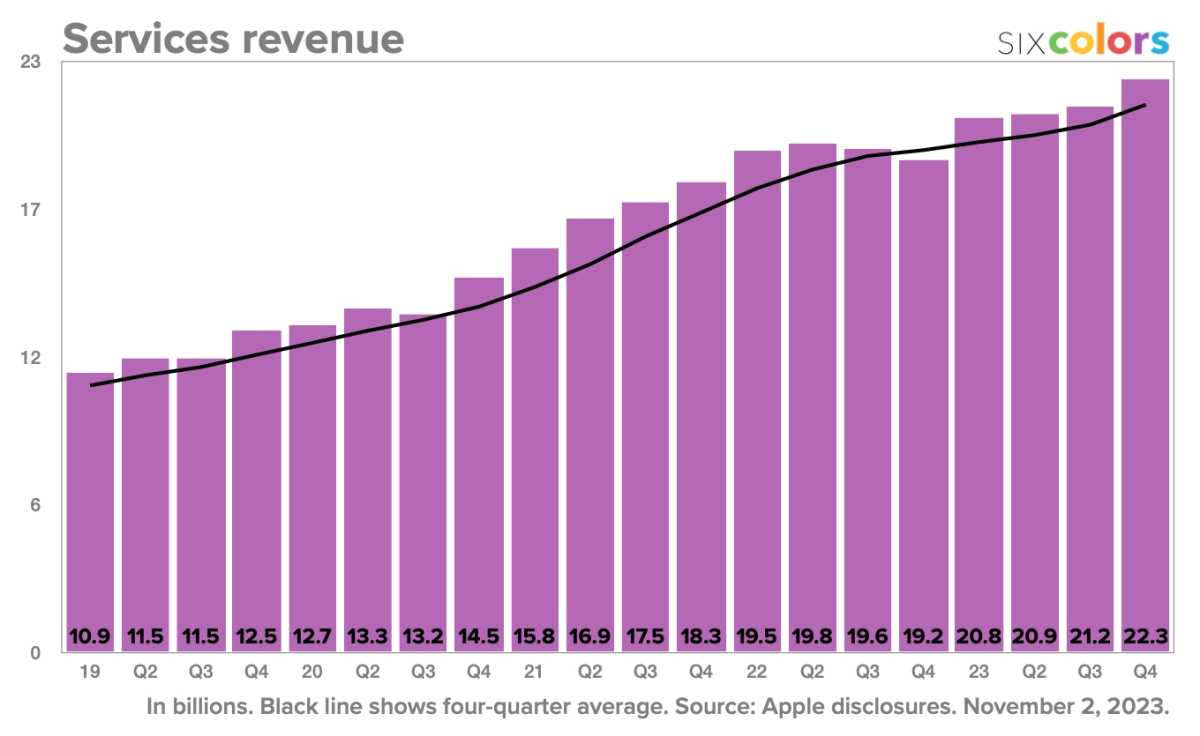

The ceaseless vivid fleck in Apple results for the retiring few days has been the Services line , which just … keep … going … up . After a few quarters of single - digit growth , service ran into another increment spirt , going up 16 percent to $ 22.3 billion in tax revenue . ( It ’s almost the size of the Mac , iPad , and Wearables linescombined . )

On top of that , table service isvery profitable . We always think about how Apple unwaveringly makes sure that its computer hardware has healthy profit margins – that ’s why they ’re not cheap!–and indeed , this past quarter , products had a consummate margin of 36.6 percent . That ’s really great .

The Services net gross profit was 70.9 percent . It ’s not even closelipped . Like gross , the Services profit margin was right smart up over the last fourth part . Why ? All Maestri said in his inclined input was that it was “ due to a dissimilar mix , ” which essentially means that there was more of somereallyprofitable material and less of some more or less less profitable clobber . Fortunately , psychoanalyst Amit Daryanani of Evercore desire to know more , so he ask Maestri for more details . Maestri ’s first reaction was 200 words of nonpayment :

We had a really warm quarter across the board , because both geographically and from a Cartesian product category standpoint we saw very significant growth . I mentioned the records on a geographic base . And from a category standpoint , literally we set record in each one of the big categories . We had all - time record book for App Store , for advertising , for cloud , telecasting , AppleCare , payment , and a September quarter record for music . So it ’s hard to pick one in finicky because they all did well . And really then , we step back and we think about , why is it that our avail line of work is doing well ? And it ’s because we have an installed base of customers that continue to grow at a very nice footstep and the participation in our ecosystem continues to grow . We have more transacting history , we have more paid accounts , we have more subscription on the chopine , and we extend to supply . We continue to tot up content and features , we ’re adding a lot of capacity on TV+ , Modern plot on Apple Arcade , new features , raw storage plans for iCloud . So it ’s a combination of all these things and the fact that the conflict in the ecosystem is improve and therefore it benefit every table service class .

rummy . You have a big winnings in services , not just in increment but in profitability , and all you want to say is , “ Well , things are setting records , and the mix changed ; what more can we say ? ”

As Stratechery ’s Ben Thompsonquipped : “ So just to recap , Apple ’s Services revenue saw a stone’s throw - modification increase in revenue with increase security deposit , and Apple executives do n’t want to talk about it . ” Like Ben , I wonder if maybe the dynamic includes change to the money Apple do on Google search referral , which are a big part of the Services linethat Apple never , ever , ever talk about in these calls . And of class , right now Google is on visitation and that hunt deal isone of the cock-a-hoop topics of conversation .

So as much as Apple wants to promote how well it ’s doing , maybe ix - nay on the oogle - homosexual decent now ?

Secrets of Apple’s success

I write a lot of article that make an assumption about how Apple plans its Cartesian product strategy , so it ’s skillful when an Apple executive reinforces that the assumption is based in reality . Apple keep older products on sale for long because , over prison term , they become much more profitable .

Here ’s Maestri explaining the scheme last week on the psychoanalyst call , responding to a interrogation by Krish Sankar of T.D. Cowen : “ When we launch new products , the cost social system of those product tend to be higher than the products that they supercede . It happens because we ’re always adding fresh technologies , new feature , and then we work through the cost bender over the life wheel of the product and we tend to get benefits as time goes by . ”

This is , for example , why Apple launch a tenth - generation iPad last year and kept the old 9th - generation iPad around . But next year , that 10th - generation poser will belike terminate up dropping in price and kick the 9th - genesis one into oblivion . The reason is that last year , Apple could n’t price the raw iPad broken enough to sell it at the low monetary value of the older role model . Next year , after a year - plus of gross sales , Apple will finally be able-bodied to bend the cost bender enough to lower the Leontyne Price .

So you’re saying there’s a chance

Over clip , these analyst call have become tightly scripted , and Cook and Maestri are rarely get off sentry duty . But sometimes , even a scripted response can render penetration that we might not otherwise get . I really enjoyed Cook ’s response ( written or not ) when psychoanalyst Harsh Kumar of Piper Sandler used one of his two quarterly questions to demand Cook if he regretted clothe in Apple atomic number 14 ( ! ) and if he might consider going back to a third - party chip supplier in the future ( ! ! ):

“ It ’s really enable us to build products that we could not make without doing it ourselves , ” Cook said . “ And as you get laid , we wish to own the chief technology in the products that we embark . And arguably atomic number 14 is at the heart of the primary technology . And so , no , I do n’t see going back . I am happier today than I was yesterday , than I was last workweek , that we made the changeover that we ’ve made , and I see the welfare every day of it . ”

And with that , Intel and Qualcomm throw their bouquets of roses into the trash and force out of the fourth-year prom .