I am a misanthropical , grizzled ex-serviceman of the technology wars . I go through my first payment organization in 1995 , and just a few calendar week ago was programming in PHP to cover refunds through the on-line defrayment processorStripe ’s first-class user interface .

But when I saw the variants on the newspaper headline , “ put-on come to Apple Pay , ” I envision what was state was n’t true . Apple retains so very little information about deferred payment carte register to a phone , and tucks it away so securely , that this scenario seemed exceedingly unlikely .

And that ’s turned out to be the character — include in the further explanation in the consistency of article that lead with that standard . In truth , the problem has little to do with Apple , and you have additional tools by which you may can protect yourself should you go through what I line below .

Charge ahead

A blog written by a advisor in the fiscal manufacture , Cherian Abraham , noted two weeks ago thatApple Pay was face a eminent level of fraudbased on his ongoing conversations with clients and others in his field . Fraud rates as high as 6 pct have been run into . It ’s insufferable to control or contradict his claim , but his path record is excellent , and let ’s take it as precise .

Once the batting order get into Apple Pay , they ’re secure . Verifying that you ’re summate batting order you ’re authorize to use is , correctly now , on the bank .

The sham , however , is n’t in Apple Pay : it ’s in the check cognitive operation by which banks allow a carte added to an iPhone to be enrolled in Apple Pay . That process is entirely controlled by the banks . Along with your credit bill of fare number , expiry escort , and other details , Apple sends several signal to banks that are used to fix whether a valid substance abuser of the card is trying to enroll it .

As mention in Apple’siOS Security Guide :

to boot , as part of the Link and Provision outgrowth , Apple shares entropy from the gadget with the issuing camber or web , like the last four digit of the phone number , the twist name , and the latitude and longitude of the gadget at the sentence of provisioning , rounded to whole act .

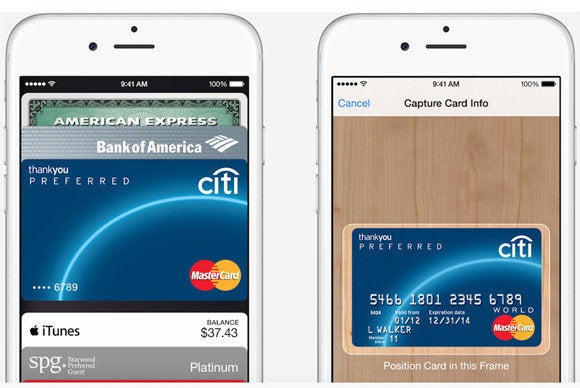

Apple declined to declare oneself more perceptivity , such as whether deal a moving-picture show of a bill of fare , which is then analyze on the phone to enter the credit placard number and expiration appointment , was a signal commit as well , or any singular attributes of the earpiece , like its cellular web IMEI identification number . As for latitude and longitude , while it ’s potential to wangle out a GPS receiver , the variety of criminal necessitate in fraud is improbable to have the equipment and interest in that kind of fiddly work ; they engage in bulk fraud .

An Apple spokesperson provided a statement about its stance :

During apparatus Apple Pay expect savings bank to verify each and every bill and the bank then fix and O.K. whether a card can be impart to Apple Pay . Banks are always reviewing and ameliorate their approval process , which varies by banking company .

Abraham , in his web log , provide extra detail about the process from his insider noesis : Apple has two path of approval , “ Green Path ” and “ Yellow Path . ” If one of several signs on Apple ’s side are off , such as a recent change to one ’s Apple ID or no action on the story for a year , Apple requires depository financial institution to utilize the Yellow Path approaching , which is a high standard of validation . Abraham spell that Green Path enrollments , about 60 percent of the total , have an exceedingly low fraud charge per unit .

With Yellow Path , banks are command to use a higher standard to ensure that the card is being lawfully add to Apple Pay , up to requiring a speech sound call to a religious service shopping mall , which obtains additional data — and is subject tosocial engineering . ( In set off six add-in across four camber , the most I ’ve experienced is a delay of under a day . In some type , I was surprised tonotbe asked for more establishment . )

This is a alike or identical appendage that bank go through whether you receive a physical card in the mail , habituate another peregrine payment system , or enroll with Apple Pay . Abraham discombobulate Apple under the charabanc , which is his prerogative , as he says banks were n’t given enough time to storm up their customer service staff and training , and thus it ’s clear that representatives are being fooled . As with most things involving Apple , partners ( like cellular carriers ) be after for low volume , even when the prevision is high . Remember multiple waves of failure with activating servers for iPhones ?

So lease ’s be clear-cut . This “ Apple Pay fraud ” :

What the pseudo truly is ? personal identity theft involving a hole in bank security procedures that will rapidly close as training and other processes improve .

If you find that one of your deferred payment card is used fraudulently with Apple Pay , it ’s because the card number was steal from a merchandiser , large ( like Target ) or small , and then added to an iPhone through identity theft or societal engineering . People who never used Apple Pay may notice their card misused , as a result .

Monitor fraud with Apple Pay

We ca n’t control whether our lineup are misused with Apple Pay or any mobile or other payment system . That ’s a trouble decent now in terms of retailers — brick and trench mortar as well as online — right adhering to exist standards set by the major credit - card issuers , like Visa and American Express . But we can add more watchfulness without driving ourselves crazy .

All major banks and credit unions have iOS apps , and many have more and more useful web site . You do n’t need an iPhone 6 or 6 Plus to use these apps , but it ’s a neat dance between Passbook , Apple Pay , and the apps when everything is aligned .

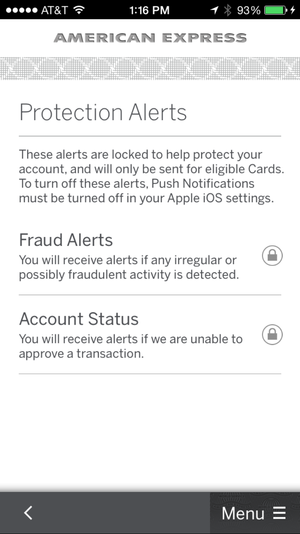

The Amex app for iPhone has few alternative , and fraud notifications ca n’t be blue-pencil .

I recently got an American Express visiting card for hotel point . After add the batting order to Apple Pay , which resulted in an email confirming registration , I also installedthe Amex app . The app works with Touch ID as a gracious added benefit . On Amex ’s website , I total the pick for the company to notify me whenever a charge exceeded $ 200 .

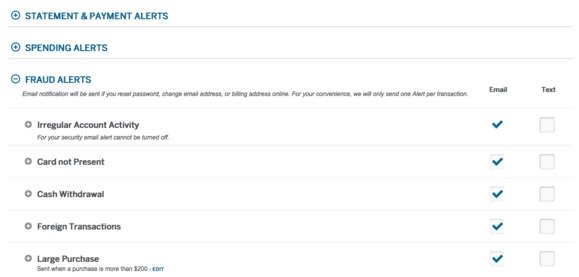

Whenever I make a bursting charge , a push notice appears . It ’s rather reassuring to get across Submit on a internet site , and seconds after see a confirmation on my iPhone curl filmdom . With my fraud sic thresholds on the website , I also receive an electronic mail alert for “ circuit card not present , ” which includes all online order .

Amex ’s website has a panoply of warning signal , which can be save via email and textbook messages ; some of these also then appear as notifications in iOS .

Every bank and credit union ’s alternative are different . If yours does n’t offer mobile , energy , or e-mail alert about rum behavior , you should pester them , and explain how competitor X has such a notification .

Financial institutions should — and I expect some will soon — give away one of their fraud markers that they currently do n’t : location . I ’d be felicitous to geofence my bill - present spending , and say if the posting is truly present or used via Apple Pay ( a human body of strong-arm presence ) outside of that expanse , it should require additional approval . Likewise , I want to approve my first dealings with any online site . Those two measures alone would vastly reduce fraud ( a monetary value to banks and consumer ) and hassle ( mostly born by consumers ) .

Apple Pay fraud is n’t in your handwriting , and it ’s not fraud with Apple Pay . you’re able to continue watchful with Io and e-mail , and head off circuit board stealing , whatever its origin .