If you were bore of all those narration every three months about Apple ’s quarterly financial results setting records and posting one banner quarter after another , I ’ve got great news ! Apple’sfirst fiscal after part of 2023 – covering the vacation one-fourth of the calendar class 2022 – was only the company ’s second - largest quarter ever , ineffectual to match up with the same fourth a year ago .

The world of Wall Street does n’t worry so much about Apple ’s tidy $ 30 billion profit during the quarter . It ’s more disturbed about that 5 percent yr - over - yr declension – the company ’s first such decay in almost four years . luckily , Apple executives were well prepared on Thursday to excuse what happened . You see , it ’s all about headwind .

Captain Cook takes on the macroeconomic headwinds

You get laid things are spoilt when the maritime metaphor come out .

During Apple ’s hourlong quarterly league call with Wall Street analyst , the word “ headwinds ” was used 11 times , somewhat edging out the 10 times we get a line the word “ macroeconomic . ” ( They were used together as “ macroeconomic headwinds ” three fourth dimension . )

“ From a supply chain point of view , we ’re now at a breaker point where [ iPhone ] production is what we need it to be , and so the problem is behind us . ”

If you ’re not someone who is as well - versed as Tim Cook and Apple CFO Luca Maestri in navigate the jerky seas of modernistic business , let me explicate what ’s going on here . The U.S. dollar sign has been inviolable , so stiff that it make Apple ’s positive business organization course in other state look damaging .

“ On a constant currency basis , we grow year over twelvemonth and would have arise in the vast majority of the markets we track , ” Cook said on Thursday . This is the affair about Apple , as an American company , report all its resolution in U.S. dollars . In China , you might look at what Apple sell last year and this twelvemonth and see that sale are up ! But if the U.S. dollar has beef up in the last year , the change in exchange pace will make last year ’s number seem largerwhen converted to U.S. dollars .

accord to Apple , the iPhone sales decline it cover was “ roughly bland ” when currentness was held constant . These are the headwind . ( I guess it assist Apple justly for , a few years ago , ceasing to report naked unit sales and decide to only describe revenue amount . Unit sales do n’t face currency headwind . )

To be fairish , Apple also listed two other reasons for its bummer of a quarter . As the society warn about months ago , there were COVID shutdowns at the mill that made Apple ’s most of import products , the iPhone 14 Pro and Pro Max . in good order during the first stern of sales of those phones . That ’s … not good . And it entail that , for much of the quarter , Apple was unable to meet the need for those very profitable high - goal iPhones . fortuitously , according to Cook , “ from a supply string point of view , we ’re now at a point where production is what we postulate it to be , and so the problem is behind us . ”

Then there ’s the word “ macroeconomic , ” or as Cook line it , “ a challenging macroeconomic environment as the world continues to present unprecedented circumstances , from inflation to war in Eastern Europe to the endure impact of the pandemic . ” In other word , the world ’s got inflation and mayhap recession , and people are n’t buy like they used to , and that includes Apple intersection .

with the iPhone 14 Pro affected sales .

Dominik Tomaszewski / Foundry

Is the macroeconomic situation due to get unspoiled or worse ? Apple was more or less mum on the subject , but psychoanalyst Krish Sankar used the phrase “ softening macro ” on the call and … I do n’t require to hear about a softening macro ever again .

Billions and billions served

In the last year or two , Apple has begun to pump up a novel statistic by which it wants to be measured : the size of its user base . In other words , when someone buys a newfangled Apple product and recycles the erstwhile one , the user base does n’t get . When someone buys a new Apple product and reach down the old one to someone who does n’t have one , or someone swap from the competitor to an Apple production , the exploiter foot grows .

On Thursday , Apple trumpet a Modern milepost : two billion dynamic Apple devices in its installed base . That ’s telling , specially when you deal that seven years ago , the installed foundation was roughly one billion .

indisputable , one reasonableness Apple likes to mouth about the install base growing is that it provides right intelligence even when overall sales are down . But the enceinte issue is how the installed base tie into Apple ’s overall ecosystem . If you ’re Apple , the more hoi polloi and devices , the more chance there is to sellmoredevices to those people . And when you ’re a company that is also increasingly reliant on services income , those drug user and devices are vitally important .

“ The first step is always the installed base , ” Maestri order . “ The establish base is the engine for service emergence , and the fact that the installed base is growing very nicely , and in a lot of emerging markets it ’s growing even quicker , that gives us a larger addressable pool of client . That ’s incredibly authoritative . ”

When people sing about the Apple ecosystem , this is what they intend . You buy an iPhone , then a Mac , then some AirPods , then an Apple Watch , and before you know it , you ’ve got the Apple One bundle , and you ’re buy yoga pants with Apple Pay to use with Fitness+ . ( Apple does not sell yoga pants . Yet . )

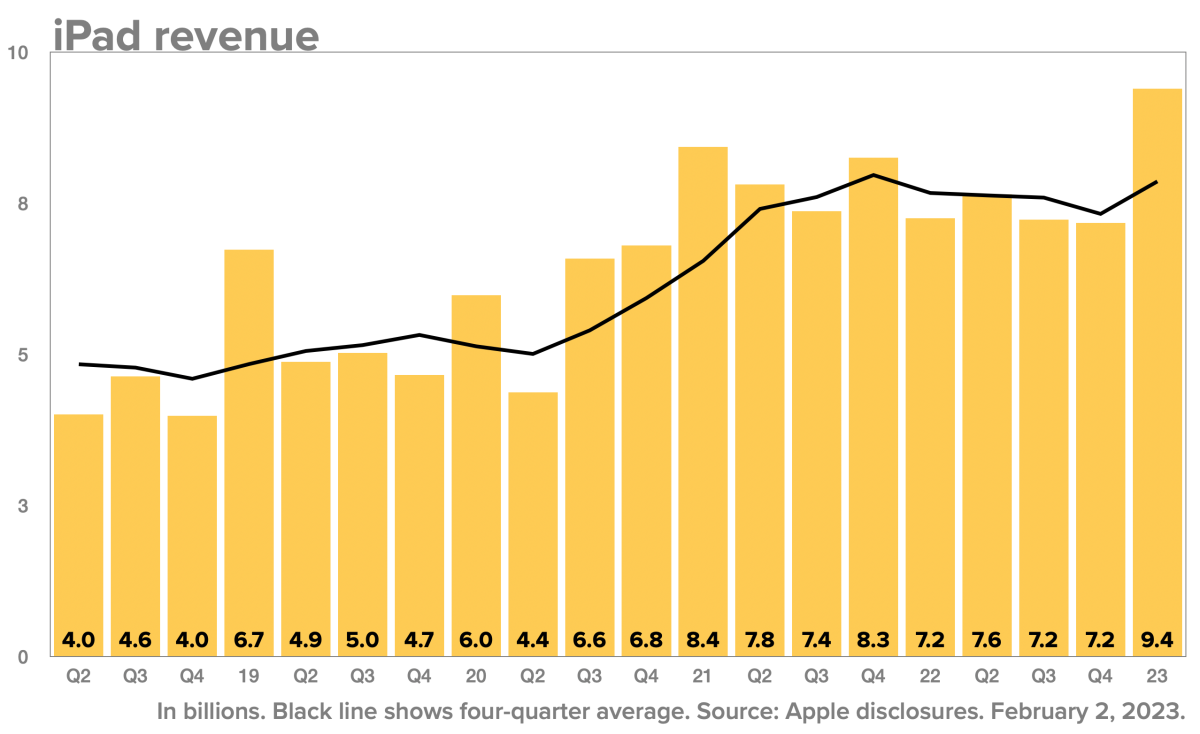

The iPad is a shining star

If you had “ iPad revenue blows up ” on the bingo card , hail down to the front and pick up your free turkey . There ’s no Apple product that seems to yield as much consternation and confusion as the iPad , but we have to give the little guy its due : it generated $ 9.4 billion in taxation , up 30 pct over the class - ago quarter , despite “ significant foreign - telephone exchange headwinds , ” harmonise to Maestri .

Of course , there are some good reasons for this big jump . The iPad faced supply constraint during last yr ’s vacation quarter , suppress sales . And this class , there was muckle of supply – as well as the new tenth - multiplication iPad and the M2 iPad Pro . So the iPad sold and sold well – with more than half the people who bought it entirely new to the iPad ! Amazing .

Since the iPad is taking a triumph lap , let me hit you with a few other iPad tidbits . It ’s the first clock time the iPad has sold better than the Mac in a quarter in seven old age . It ’s the second - biggest iPad after part ever , and the biggest iPad quarter by revenue innineyears . The iPad is , at this distributor point , basically a $ 32 billion a year business for Apple , when just a few years ago , it look like it might be worth $ 20 billion at most . Sure , we might look at that janky Apple Pencil adapter on the 9th - propagation iPad and at the aging design of the iPad Pro and marvel what ’s up with the hardware design , but the numbers do n’t lie .