Since the advent of Apple Pay back in 2014 , Apple has slowly but surely rolled out a number of other financial - link ware : Apple Cash(née Apple Pay Cash ) in 2017 , theApple Cardin 2019 , the recentApple Pay Laterservice , and just this past week , the newApple Card savingsaccount .

It ’s a lot of interest – if you ’ll excuse the expression – in the fiscal land for a company that tend to be focused on cutting - boundary engineering science , especially given that , in the U.S. at least , the banking system is anything but .

Nevertheless , with all of these various oblation , Apple seems well poised to become something a snatch like a bank in its own right . Why would Apple require to be a bank ? Well , in the apocryphal words of famous bank robberWillie Sutton : “ That ’s where the money is . ” But to zoom out and take the 35,000 - groundwork perspective , there may be even more of a retentive game play out here .

The more you spend, the more you save

The recent announcement of the Apple saving account is , on the nerve of it , a puzzling one . Like many of the other Apple fiscal products , there ’s no obvious way that money flows to the company : it ’s not requiring a minimal balance and there are no fee . Moreover , by offer a very competitive 4.15 percent pastime rate , the party is really give money back to the consumer . ( It ’s worth note that Apple savings does have amaximumbalance : $ 250,000 . And if that turn sounds intimate , it ’s credibly because you ’ve been pay aid to the details of late depository financial institution collapses : $ 250,000 is the maximum amount insured by the FDIC . )

But that ’s looking only at the tactical situation . From a strategic standpoint , an Apple savings account with an attractive interest pace encourages consumer to leave more of their money in Apple ’s hands , to do good from the payoff . Not only is that money that ’s within Apple ’s ecosystem ( albeit under the auspices of their banking collaborator , Goldman Sachs ) , but it ’s money that is n’t travel elsewhere – specifically , being transferred out to another account .

That encourages user to keep making Apple Pay and Apple Card purchases since they can in turn shovel more funds into this high - interest account and earn even more money . That ’s upright for the user – they gain money – and it ’s well for Apple because more money begets more money .

Two’s company

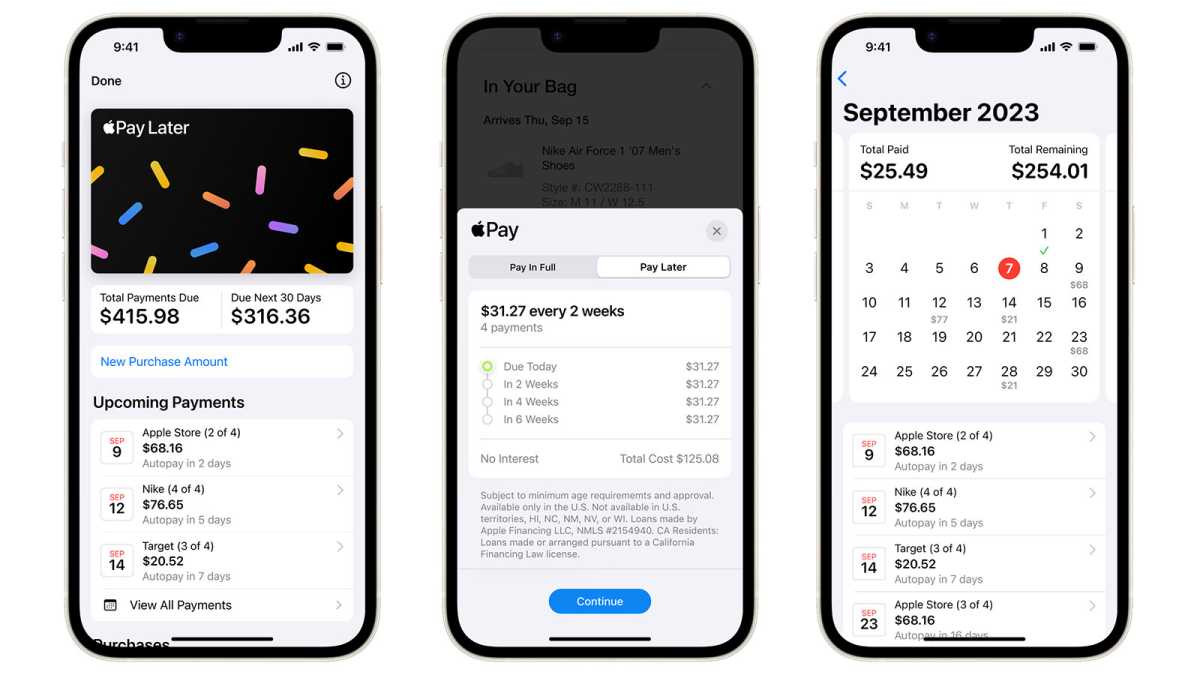

Attentive Apple watchers may also have notice one other interesting detail in the company ’s late announcement of its Pay after lineament . Unlike the Apple Card and the savings account , the Pay tardy organisation is n’t backed by a financial cooperator , but rather by a underling of Apple : Apple Financing , LLC . That troupe handles the loan aspects of Pay Later , such as performing credit checks , providing the fund to make purchases , and treat repayment by the consumer .

create an only new company to specifically divvy up with these kinds of project may not be a particularly surprising move for something that is this far out of Apple ’s burden competency , but it is a significant one . If nothing else , it makes decipherable that this is n’t some pass partiality for Apple , but an effort that it ’s putting pregnant metre and resources behind . It also seems to hint at next Apple development in the financial engineering region .

Apple

But if Apple is n’t done with its motility in this market , it still raise the head of whether there is a larger strategy at stake , something that plays more into Apple ’s factual business intensity .

A bank, but not as we know it

You do n’t have to look very heavily intemperately , in fact , to see how these markets of finance and applied science intersect . Apple Pay is a stellar example : while it did n’t originate contactless defrayment , it did go a long way to popularize them – to the decimal point that I now draw into direction fewer places that do n’t take Apple Pay than that do .

But as I mentioned above , here in the U.S. , “ banking ” and “ technology ” often feel at betting odds . I know many masses who still conduct in report checks , and bank transference are still clumsy and dumb compared to other places around the world .

And part of me wonders if Apple pick up this same dysfunction and thinks , “ Hey , what if we could improve that experience ? ” in the same way that Apple Pay has improved retail purchasing . By slowly rolling out fiscal products , the fellowship gives itself a foothold in the industry , and some tegument in the game to boot .

What that might look like is anybody ’s guess , but Apple ’s establish before that it can make compelling arguments for its ecosystem meliorate on a received ( iMessage , for one instance ) . And with the monumental e - commerce system the company already has in place via the App Store or its many subscription services , there ’s sure as shooting an argument to be made that Apple knows quite a bit about the financial patronage already .

I , for one , would be entranced to see Apple becoming a significant enough participant in the financial industry to handle that influence in improving my banking experience . What if transplant fund was as loose as Apple Pay ? What if I never require to write another paper deterrent in my life ? All of those feel like annoyance points that Apple could aid solve if it twist its will to the job ; and perhaps , based on what it ’s done so far , it ’s got just such an estimate in idea .